bunq review – How good is the bank of The Free?

bunq is a Dutch bank that offers current accounts and card products for private individuals and business customers. With a European banking licence based in the Netherlands, bunq can operate not only in Germany or Austria, but actually throughout Europe, like Spain, Italy or Belgium.

As a “smartphone bank”, you can open a bank account on your phone within minutes. It’s easy to use, has a pretty good app and comes with a bunch of useful features. This way, everyone can customize their account individually. Services such as Google Pay and Apple Pay are included, you can use SEPA transfers or set up standing orders. Cash withdrawals at ATMs or shopping by credit card are possible as well with either a debit Mastercard, a Mastercard credit card or a maestro Card. The current account from bunq can therefore be used for pretty much everything you need and is a good companion for everyday life.

But what does the account cost? What are the requirements for opening an account? What other features are there? We’ll show you all of this in today’s test.

Our bunq bank account review at a glance

- Open a Checking Account in 5 Minutes with a MasterCard

- Includes a Maestro card, 25 online cards, and the option to open sub-accounts.

- No credit check required for opening.

- Mobile bank with a top app, Google Pay, Apple Pay, and web access.

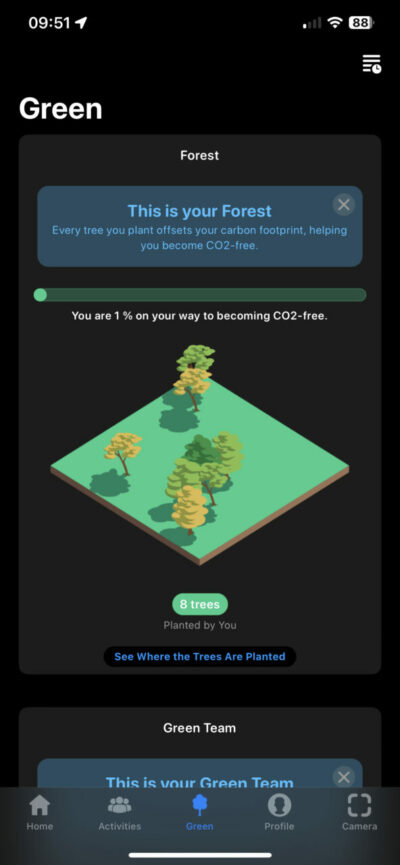

- Sustainable and environmentally conscious banking.

- Currently offering 3.36% interest on the account with MassInterest.

How did we test?

For our test, we compared all account models and extrapolated the costs of use for one year. Our base of operations is Germany, therefore we focused on usage for Germans or Expats in Germany, although the features are the same in all available countries. The bunq app on Android (Google Play) was used and experiences and reviews from other users where gathered. We opened a bunq Easy Green account and tested over several months (still ongoing). In addition, the general terms and conditions and data protection statements, the pricing overview and the regulatory fee information (“Entgeltinformationen”) for bunq Easy Green Personal and bunq Easy Green Money dated 17 February 2021 were consulted.

Due to the changing costs, services and frequent updates by bunq, we cannot guarantee completeness and ask you to refer to the information on the bunq website yourself.

Pros and cons of bunq

Pros

- Easiest Account Opening: In provider tests, bunq had the fastest account opening process. You can access your account within 12 minutes.

- 5 Account Types, 2 for Free: Choose from flexible account models with various features: Easy Savings (free), Easy Bank (€3.99/month), Easy Bank Pro (€9.99/month), and Easy Bank Pro XL (€18.99/month).

- Up to 26 Virtual Credit Cards and 25 Bank Accounts in Pro Models: The Pro models allow you to have up to 26 virtual credit cards and 25 bank accounts.

- 6 Free Cash Withdrawals with Pro Versions: Enjoy six free cash withdrawals per month with the Pro versions.

- 7 Languages, 5 IBANs: bunq embodies diversity, evident in its logo. You can use the app and get support in 7 languages. Additionally, you can obtain IBANs for DE, NL, FR, ES, and IE.

- No SCHUFA Check: According to its privacy policy, bunq does not collaborate with SCHUFA. This means you can open a bunq account without a SCHUFA check. The same applies to KSV 1870.

- Simple Banking: As of the review date, the bunq app is rated 4.3 stars on Google and supports all functionalities, offering banking right in your pocket.

- Interest on Balances: bunq calls their interest scheme “MassInterest.” In February 2024, they offered 4.50% interest, 3.50% since March, and 3.36% since July. This makes bunq a solid option for savers.

- API Banking and OAuth: bunq provides API access to your account, which is advantageous for developers or anyone looking for an API-enabled bank.

Cons

- No real free account type: All proper accounts that include cards can only be used for a one-time or monthly fee. In return, bunq offers a free trial phase in which you can test the account.

- No overdraft: Overdrafts are not possible with bunq. You can only spend what you have.

- No loans or credit card with credit limit: If you need money, you have to get your loan from somewhere else (for example: us). At least the debit card can be used as a handyvirtual prepaid credit card.

- Fresh off the boat: bunq is a young bank. Therefore, some issues or “bugs” can sometimes occur with the app.

- Fees and fee model: There are so many cool features that it is sometimes hard to keep track of what is free and what is not. Therefore, you should take a closer look at the fee structure.

What account types does bunq offer?

bunq basically offers several different account types that can be used by private individuals or business customers. The three models are called bunq Easy Savings, Easy Bank and Easy Bank Pro and Easy Bank Pro XL. The accounts differ from each other. While bunq Easy Savings has no monthly fees and is suitable as a low-cost alternative to your own account or especially for travelling, a bunq Easy Bank Pro XL account is the right choice for a power user.

Here is an overview of the most important functions of the different subscription accounts for private individuals:

The bunq Metal Card is only included with Easy Green and Easy Money if you purchase respectively an annual and a bi-annual subscription directly, i.e. pay 12 or 24 months in advance. All other details are based on our research, but may vary due to changes in bunq pricing or service adjustments.

The different cards available for the Easy Money and Easy Bank account models are a Maestro card, a Debit Mastercard and a so-called Travel Card, which is a Mastercard credit card. For special patrons, there is also the exclusive Metal Card made of high-quality stainless steel.

The card types that are included with the accounts or can be added:

Maestro Card (deprecated)

MasterCard Debit

Exclusive Metal Card (available again starting October 2024)

Which features are included in the accounts?

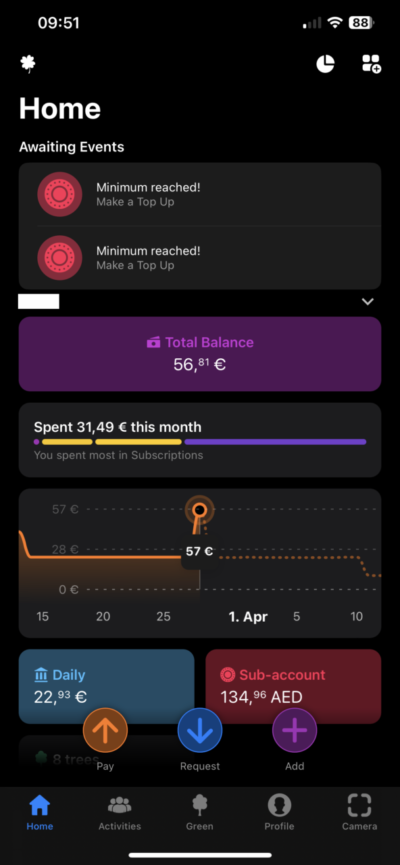

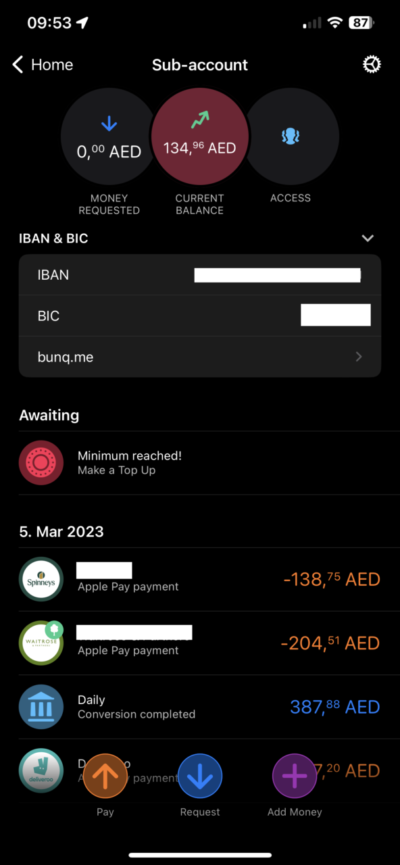

bunq is not just any bank, but offers many more features, especially for lifestyle, sustainability and easy banking. For example, you can easily budget with your sub-accounts and sort your income and expenses. You can create very simple savings rules where, for example, every payment is rounded up and posted to your savings account.

With push notifications, you are always informed when something happens on your account. Direct debits are also announced first and you can review and confirm (or decline) them.

bunq works with Wise (previously Tranferwise), which allows you to send money to other accounts at the real exchange rate in 39 currencies – directly from the app.

You can easily split expenses in groups with a slice group, making it easy to settle your camping trip or restaurant visit with your friends.

Our list shows what else is available:

How do I open a bunq bank account?

Opening an account with bunq is quite simple. Either you start on the website or you download the app directly from the App Store or Google Play Store (app is called “bunq – bank of The Free” on Google and Apple). The following requirements must be met to open an account:

- Minimum age of 18 years or confirmation of opening by parent or guardian for minors

- Valid mobile phone number and email address

- Valid passport or identity card (for identification)

Now to open an account. The first step is your mobile phone number, with which you confirm, that you are serious and a human being. Then you will be asked for your name, date of birth and gender. Now you will receive a 6-digit code on your mobile phone or your email address, which you use to confirm your login.

In the second step you have to identify yourself. You will need

- valid ID (identity card) or

- valid passport

- if applicable a certificate of registration (“Meldebescheinigung”)

In contrast to the classic identification at the post office (“Postident”), you can simply upload the document and confirm your address data with it. bunq now checks your application and will then activate the account accordingly.

In which countries can I open a bunq bank account?

bunq is international and can therefore be used in almost all countries in Europe. The basis is actually the “European Economic Area”, i.e. everywhere where banks use the SEPA network. This differs from the EU, for example, and also from euro countries. Currently, bunq is available in the following countries:

bunq is not available in Switzerland or in other non-European countries. In some countries such as Poland, Romania or Hungary, bunq is completely blocked and cannot be used.

bunq review: What we think of the smartphone bank

The uncomplicated and, above all, quick application via app particularly convinced us with bunq.

The necessary information is limited to the most important. Name, address, mobile phone number and email – that’s all you need. Identification is also kept simple and the account is activated directly after verification from bunq’s support.

With instant-payments, Wise partnership and the features like bunq.me, you quickly have money in your account that you can use. With Google Pay or Apple Pay, you also don’t need to wait for the cards to arrive by mail, because your phone can act as a card.

Mobile banking with a fully functional app from which you can control everything. 3 cards, 5 digital accounts and up to 25 IBANs for perfect money management.

The most important features are absolutely fulfilled by bunq. Nevertheless, we didn’t give it 5 points because we think important features that are part of a bank are missing. These include, for example, the possibility to overdraw one’s account. Personal loans, payday loans or an actual credit card are also not to be found in the portfolio.

Moreover, the many features are not always free of charge, so sometimes fees are incurred without realizing it. These are regularly debited from the account, but also only if there is credit available. If the account is not funded, there are time limits, but experience reports also speak of account blocks or seizures. We are not in a position to judge this more precisely. For the basic features “account and card” we therefore give 4 out of 5 stars.

Everything has its price, that’s why there is no free bunq bank account. The cheapest is the Easy Bank account, which is rather suitable as a second account for a better money management. Further fees and costs are then incurred when using the account, for example when withdrawing money or adding a card.

The two accounts Easy Money and Easy Green each cost 8,99 or 17,99 Euro per month and are therefore not cheap. If you are not a power user, the Easy Money account will probably be enough. The biggest bonus with the Easy Green account is the Metal Card if you pay 12 months in advance. In addition, there is a CO2 bonus, which is already included with Easy Green. However, if you are looking for a free account with a debit credit card, you should rather look at the product of DKB or comdirect. We give it 3.5 out of 5 points.

From our experience, no bank has so many different cool features with which you can do community banking. Opening a joint account in a few steps, sharing bills, sending money to people you don’t know the IBAN of and so on and so forth.

The 25 sub-accounts and IBANs also help to keep your finances in order. With the rounding feature for automatic savings and the interest on the balance, saving money is a bit of fun again. Loyalty cards are also in a single wallet, so you can collect points and earn interest – all from one app.

The service is easily accessible via chat and responds quickly. Availability in 7 languages is definitely a plus. More complex enquiries have to be passed on to specialized departments, but that is probably the case with every bank. With the latest Update, it is also possible to forward a video of your screen to the customer service to get a solution for your in-app issues.

The app is updated regularly and new features are announced in bunq keynotes – as you know it from Apple.

Contact information and bunq phone number

Frequently asked questions about bunq

Yes, bunq is a real bank and has a Dutch banking licence which is valid in the European Economics Area. Therefore, you can also use it in Germany or Austria as well. As a Dutch bank, it also advertises in Germany.

The cheapest account from bunq is the Easy Bank, which requires a € 2,99 monthly fee when it is opened. The bunq account is therefore not free of charge. The other two products Easy Money and Easy Green cost € 8.99 or € 17.99 per month.

Additional fees can apply with Easy Money or Easy Green for the following:

- additional cards (apart from the 3 included)

- if there is more than € 100,000 on the account

- for more than 10 cash withdrawals per month

- for SWIFT payments (usually outside the euro area)

- for additional bunq +1 members (€ 2.99 per month)

When signing up, please check the price and service lists on the website or in the app of the bank itself, as these may well change and also differ depending on the use and model.

bunq is a Dutch bank, so you also have a Dutch IBAN. This starts with “NL” and not with “DE”, as is the case for German bank accounts.

The format for a bank transfer is then as follows:

IBAN: NL01BUNQ23456789012

BIC: BUNQNL2A

The BIC is sometimes also given as BUNQNL2AXXX, both work. Please note that the law does not forbid you to transfer money to a foreign bank account. Nevertheless, the Dutch IBAN could perhaps lead to queries in the case of state payments (child benefit, unemployment benefit). With the SEPA reform, however, this payment cannot be refused.

As a smartphone bank, you actually use your app for everything with bunq. The first thing you do is register with bunq using your mobile phone number. Once you have identified yourself and registered, you can use your bank account. In the app overview, you can see your accounts, your cards, what you have spent this month and, for example, savings accounts or joint accounts.

You can find the IBAN of your account in the app. Select your main account on the main screen. You will then find your IBAN in the top line. It starts with “NL” and has 18 characters. Dont be surprised: As it is a Dutch IBAN, the format is slightly different from a German IBAN. That is why you have letters in the middle of the IBAN (digits 4 – 7).

Yes, minors, for example pupils, can also open a bank account. However, the consent and permission of an authorised representative or legal guardian is required when opening an account. This is usually the mother or father.

In order to open an account as a minor, you must therefore specify the adult guardian in the registration process, who will then approve your account opening in the app. In some cases, bunq will ask for proof that this person is authorised to represent you.

SCHUFA is not checked at bunq, which is why the account is possible without SCHUFA. As far as we can see, there is no official statement from bunq on this, but neither the general terms and conditions nor the data protection declarations contain any permission to share data with SCHUFA as a credit agency. Therefore, a negative SCHUFA does not have to be a hurdle for the account.

The bunq Metal Card stands out due to its special design and is sustainably manufactured from high-quality stainless steel. If you want to get the card individually, you have to pay € 129 for the Metal Card (as a Pack member) or pay 12 months in advance for the Easy Green account type or 24 months in advance for the Easy Money account type.

Your money is protected at bunq by the statutory deposit guarantee scheme of the Dutch Central Bank up to € 100,000 per person. The Dutch legal deposit guarantee system of “De Nederlandsche Bank N.V.” is therefore very comparable to the German deposit guarantee protection. Your deposits are protected up to an amount of € 100,000.

Are you a bunq user? What are your experiences with bunq’s bank account so far? Or are you planning to open an account but still have questions? Let us know!

I have been using the services of this bank for almost a year now. And so I can summarize some of the results.

Firstly, everything that seemed to me as a disadvantage, in practice, turned out to be a peculiarity of the bank. Apparently, I got used to my previous bank and it took me a while to get used to the new application.

All the banking operations went smoothly. As for the transaction time, in general, it is the same as with any other bank.

The application has some bonuses. But I didn’t go into how to use them, as I’m not interested.

I have been hearing a lot from my friends about how disruptive this company is to the banking industry, how they are shaping the future. I think they are exaggerating the reality a bit. It’s not the greatest application, but the platform is okay, the features are nice, my money is safe.

I’m a newly registered customer of the bank, but I can surely see the myriad of advantages of using this bank and this app.

But I want to know about the scheme of payments of the interest of my deposit. Is it calculated by percentage of each day or by a sum of money that is on your account at the end of the month?

Hi Giovanni, generally, banks calculate the interest rate on a daily basis, so the amount at the end of each day is the relevant factor for calculating your interest payment, not just the amount at the end of the month.

I made sure that this service meets my requirements. Of course, it has some glitches but they are not so significant so they could prevent me from collaborating with it. So, in my eyes this bank is mostly advantageous. I would even recommend it to other people.

I’m gradually getting used to digital banking, although not so long I was ultra-conservative.

banking services of a healthy person…

it’s wondering to me how competitors are still alive if such a company continue developing and acquiring more customers.

These are all good account types, and I understand that the more you pay for an account, the more features you get. But should I really go for the Easy Green account? What advantages does it have over the Easy Money account, that would be definitely necessary for me to pay for it?

Eine ganz okaye Online-Bank mit sowohl Vorteilen als auch Nachteilen im Vergleich zu der Konkurrenz.

Insbesondere ein Vorteil ist, dass man hier höhere Zinsen bekommt auf das Geld, was man auf dem Konto hat.

For me the most important thing is that they are OK with mobile banking and mobile payments 📱

Connecting google pay and making payments is what I need most from this bank.

Haven’t notice too many bugs in the app to be honest. Maybe its just my personal experience I don’t know.

However credit cards would be a pleasant audition to the existing services. We all are so accustomed living on credit.

Hey guys, I am new to this bank and place. All good but I want to know is there any fee for withdrawing money?

It depends on how you are making this withdrawal.

If you withdraw money using the same currency as on your account, then thee are no fees, however, when it comes to the currency convertation, then there is a 0.5% fee taken by the bank.

Also, remember that commissions may vary from ATM to ATM, as diffreent merchants have various conditions.

I do not like the part where the author said that bunq is a new bank and that is a disadvantage. What do you think, just new banks have bugs and some issues?

Ummm, He’s not wrong, you know. With experience comes reliability. It is easier to trust a doctor with several years of experience than one with none. However, that does not discredit the new doctor. The new doctor might just even become a better professional. But experience shows that you can handle the pressure. With experience comes;

– More refined processes

– Better feedback from improved services

– Better management of crises

– Trustworthiness

I’ve been a bunq customer for a while now, and I can agree with the list the author of this article has made of the pros and cons, except for two of the cons:

– No overdraft

– No loans or credit card with credit limit.

I don’t see this as a disadvantage, moreover, it protects you from paying those hefty fees for interest rates. If they do that, they would be nothing better than the old traditional banks.

Quite a good and comprehensive review. However, for some aspects that you have put in the Cons basket, I would put them in the Pros basket 😀 such as no-overdraft. This is quite honest approach from them, they don’t allow overdrafts which means they are giving up some potential earnings from interest rates, and that’s why they don’t offer free accounts.

Overdrafts are a common trap for all of us, and traditional banks are making solid profits out of it. This makes them willing to give you a free account and overdraft options, so in the end, you will pay them again that monthly fee, and possibly even more than that…

I have been using bunq for quite some time, and I agree with most of the points mentioned in the the pros and cons table.

It takes time to explore all the features of the app, and as you wrote not everything is free. Their fee structure is quite complex.

Even though it is a relatively new app, I haven’t experienced any major problems while using their services.

Update from March 2, 2024: bunq has adjusted the fees for three out of four account models. Since March 1, 2024, the fees have been increased by one euro:

Easy Green Personal Account: from 17.99 EUR per month to 18.99 EUR

Easy Money Personal Account: from 8.99 EUR per month to 9.99 EUR

Easy Bank Personal Account: from 2.99 EUR per month to 3.99 EUR

Easy Green Business Account: from 22.99 EUR per month to 23.99 EUR

Easy Money Business Account: from 12.99 EUR per month to 13.99 EUR

Easy Bank Business Account: from 6.99 EUR per month to 7.99 EUR

Additionally, the 25 sub-accounts will now cost 20 euros per month. For existing customers, the new terms will apply starting from May 1, 2024.