TF Bank Mastercard Gold: Our Experiences in the Test

For several months now, we have been using the TF Bank Mastercard Gold and would like to share our experiences here. This credit card is a permanently fee-free credit card from a Swedish provider (TF Bank AB), which has been available in Germany since 2018. Its most notable core features are: no annual fee and no foreign transaction fees—even payments in foreign currencies incur no surcharge—and it also provides a decent credit limit.

This makes the card ideal for travel and everyday use, both domestically and abroad. As a Mastercard Gold, it is accepted worldwide at millions of locations (the Mastercard network spans over 35 million merchants worldwide), and so far we have hardly encountered any acceptance issues in any country. Another plus is the comprehensive insurance package: travel insurance is already included, provided that part of the trip is paid for with the card.

Despite these premium benefits, there is no obligation to open a checking account—you can use the card independently of your main bank. Overall, the TF Bank Mastercard Gold makes a very attractive first impression for cost-conscious consumers who value flexibility and worldwide usability.

We have gathered experiences with the TF Bank Mastercard Gold in Germany and Austria. Here are the advantages in advance:

Key Advantages at a Glance:

- No annual fee, €0

- No foreign transaction fee, €0

- Free travel insurance

- Worldwide acceptance as Mastercard Gold

- Quick online application

- With a credit limit and instant cash function

The Outcome of Our TF Bank Mastercard Credit Card Experiences

- 0 EUR, no annual fee

- Pay worldwide free of charge

- Credit limit with a 51-day interest-free payment period

- Travel insurance and cashback included

- Gold credit card – valid in Germany and Austria

Disclaimer: Since costs and services may change and the bank regularly updates its offerings, we cannot guarantee completeness or the most current information. Please check the information on the Revolut website yourself.

TF Bank Mastercard Gold: What This Credit Card with Credit Line Can Do

The free TF Bank credit card is a so-called “revolving card,” meaning you get a credit card with a credit limit. When you pay with your credit card, the amount is first deducted from your credit limit, which you then repay later by transferring money from your checking account. The payment deadline here with TF Bank is 51 days.

With TF Bank’s Mastercard, you also have the option to pay back your credit limit in several small installments. This means you do not need to settle the entire outstanding amount after 51 days; you only need to pay 3% of the used credit limit or at least €30. The rest is then repaid in monthly installments. However, be aware that if you use installment payments, interest is charged on the outstanding balance. The annual effective interest rate is 24.79%, so you should carefully consider how you use the partial payment feature or whether it would be better to settle the entire credit limit at once.

Advantages and Disadvantages of the TF Bank Mastercard Gold

Advantages

- No annual fee: The TF Bank Gold Mastercard is a free credit card with no annual or activation fees.

- Instant cash payout: Since 2024, TF Bank has offered the “TF Bank Sofortgeld” (instant cash) option. This allows you to transfer part of your credit limit to your account immediately.

- Free worldwide payments: There are no foreign transaction fees. Payments are free both domestically and abroad.

- 51-day payment deadline: This is a credit card with a credit limit. Unlike some other credit cards, you do not need to settle your balance at the end of the month but only after 51 days.

- Financial flexibility: The TF Bank Mastercard allows for installment payments. You can pay off your credit limit in multiple installments (with interest), giving you extra flexibility.

- Additional benefits: The Gold credit card stands out for various foreign and travel insurance options, as well as attractive cashback offers, for example on rental cars or hotels.

- Luxurious design: A gold credit card, like the one from TF Bank, is a status symbol and enhances any wallet.

Disadvantages

- High interest rates: At 24.79% APR for installment payments, TF Bank is relatively expensive, so you should use the credit limit carefully.

- Cash withdrawals not truly free: Although withdrawing cash is initially free of charge, interest is charged on the withdrawn amount immediately.

- Always requires a credit check (SCHUFA): Because this Gold Mastercard comes with a credit limit, a credit check is always performed (in Germany, via SCHUFA; in Austria, via KSV).

- Insurance policies come with strict conditions: The insurance only applies secondarily (i.e., if no other insurance covers you). Travel insurance is only valid if more than half of the trip is paid for with the TF credit card.

The TF Bank Credit Card as a Travel Credit Card? – Additional Benefits

Travel credit cards that are especially suitable for use abroad should have no foreign transaction fees and be free for both payments and ATM withdrawals worldwide. TF Bank’s card scores points here with fee-free payments in the EU and beyond. However, withdrawing cash isn’t truly free because the amount withdrawn accrues interest immediately, no matter where in the world you use the credit card.

Gold credit cards are often seen as a symbol of luxury and usually include useful additional benefits, making them potential travel credit cards. TF Bank’s Mastercard is no exception. Along with the gold Mastercard, you get insurance coverage for traveling abroad and, through the TF Bank Vorteilsclub, discounts and cashback on your expenses, e.g. for hotels at Booking.com.

Travel and Overseas Insurance Coverage of the TF Bank Mastercard

For insurance, TF Bank partners with AM Trust International, an Ireland-based insurance company. You are effectively insured through the gold Mastercard for any trips that are shorter than 90 days and have been paid at least 50% with the TF Bank Mastercard Gold.

With 7 different insurance policies, TF Bank offers a considerable range for a free credit card and provides comprehensive insurance coverage. The following insurance services are included free of charge with your TF credit card:

Always keep in mind that these travel insurance policies offer a certain level of protection. However, you should review the conditions yourself before traveling to decide whether this coverage is adequate for your needs.

Collect Cashback with the TF Bank Mastercard Gold

As the holder of the TF Bank Gold Mastercard, you are automatically a member of the TF Bank Vorteilsclub. For example, you can book your vacation through TF Bank’s travel portal and get 5% cashback. The same applies when booking a rental car. You can also receive discounts at brands like MANKIND, ZAVI, or Booking.com.

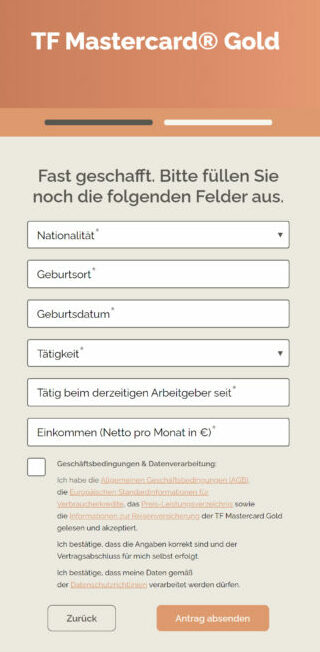

TF Bank Mastercard Gold Credit Card Application: Here’s How!

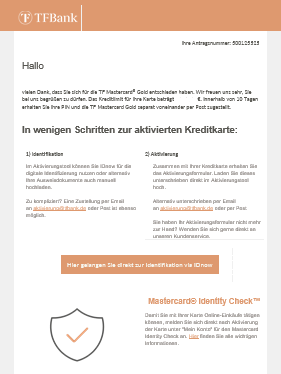

Applying for the Mastercard through TF Bank is quick and straightforward via the online form on the online bank’s homepage. The process takes place in three steps. First, you complete the online form, then you identify and verify your data, and in the last step, you activate your credit card:

What Are the Requirements for a TF Bank Mastercard Gold (Germany and Austria)?

TF Bank is a Swedish bank, and therefore the TF credit card is available not only in Germany. You must meet the following requirements to be eligible for a TF Bank credit card:

- Minimum age of 18 years (legal adulthood)

- EU citizenship (Germany, Austria, Sweden, Finland, Denmark, etc.) or, for non-EU nationals, a valid residence permit

- Regular income

- Good creditworthiness (no negative SCHUFA entries, or poor KSV 1870 and CRIF entries in Austria)

- Email address and mobile phone number

A special feature of the TF Bank credit card is that it is available to citizens of almost any nation, provided they have a valid residence permit in, for example, Germany or Austria.

What Are the Fees, Charges, and Limits of the TF Bank Mastercard?

🏦 Credit Card

| Name of the card | TF Bank Mastercard Gold |

| Provider | TF Bank AB |

| Type of Credit Card | Kreditkarte mit Kreditrahmen |

| Credit Card Network | Mastercard |

| With Own Bank Account | No |

| Negatice credit history accepted | No |

| Available Immediately (Virtual) | No |

| Rewards System | No |

💶 Fees

| Annual Fee First Year | 0,00 € |

| Annual Fee Second Year | 0,00 € |

💳 Payments, Cash Withdrawals, Foreign Currency

| Card Usage nationally | 0,00 € |

| Card Usage in the Euro Zone | 0,00 € |

| Card Usage Outside the Euro Zone | 0,00 € |

| Cash Withdrawal nationally | 0,00 € |

| Cash Withdrawal in Euros | 0,00 € |

| Cash Withdrawal Outside the Euro Zone | 0,00 € |

💰 Credit Limit, Available Credit, Installment

| Credit Available | Yes |

| Credit Limit from | 100,00 € |

| Maximum Credit Limit | 10.000,00 € |

| Minimum Monthly Repayment | |

| Effective Interest Rate (APR) | 24.79% TAE |

🧾 Availability Limits

| Daily Limit | - |

| Monthly Limit | - |

| Cash Withdrawal Limit | - |

Nettodarlehensbetrag: 1.000 €, Sollzins (veränderlich): 22,35 %, Effektiver Jahreszins: 24,79 %, Laufzeit: 12 Monate, Anzahl der Raten: 12, Höhe der monatlichen Raten: 93,05 €, Gesamtbetrag: 1.116,50 €.

Zu TF Bank Mastercard Gold »Service and Security: What to Do If Problems Arise, and How to Contact TF Bank Support

Security features: Security plays a major role with credit cards, and here TF Bank delivers solid standards. As mentioned, Mastercard ID Check (formerly SecureCode) protects online transactions from unauthorized access. The card is equipped with a chip and NFC, allowing for contactless and mobile payments (via Apple Pay or Google Pay) to work smoothly and securely.

Right after activation, we linked the TF Mastercard to Apple Pay and could use it to pay even before the physical card arrived in the mail—very convenient. If the card is lost, you can have it blocked immediately through customer service, which according to the fee schedule is free. Replacement cards or new PINs are also issued free of charge.

In the TF Bank Mobile App, you can also view all transactions, download statements, and temporarily block the card if needed. The app is straightforward and offers basic functionality, though it currently lacks extras like push notifications for transactions—which I somewhat miss. Regarding data protection and phishing, the bank provides detailed information on its website, and because it has Swedish roots, it operates under strict EU security standards. Overall, I feel well protected with the TF Bank Mastercard Gold: modern security procedures and the ability to manage everything digitally provide confidence in daily use.

Customer service: A crucial aspect is customer support if problems arise. TF Bank advertises a free customer service line. In practice, there are separate email addresses for new and existing customers (e.g., service@tfbank.de), and you can reach their card services by calling a Berlin-based phone number.

Our experience: Communication primarily took place via email. My inquiries were answered within 1–2 business days, which is acceptable. I only had to call them once (to unlock my card after entering the wrong PIN)—I was on hold for about 10 minutes, which wasn’t too bad. However, other customer reviews indicate that service doesn’t always work smoothly. According to a Finanztip survey, around 50% of customers rate TF Bank positively, while 43% report negative experiences. The main complaints are long wait times and unanswered emails.

To be fair, it’s worth remembering that you’re dealing with a purely online bank with no branch network—so there’s no local bank advisor. If you’re used to self-service and email communication, you’ll manage fine. But if a serious problem arises, you might need to have some patience before it’s resolved.

Conclusion: Who Is the TF Bank Mastercard Gold Worth It For?

The free TF Bank Mastercard Gold credit card is very well suited for booking travel as well as for everyday shopping. As a sole credit card for everyday use, it is less suitable because withdrawing cash quickly incurs costs. However, it’s an excellent supplement to the debit card or Girocard from your checking account.

The card is particularly good for vacation bookings, as you can benefit from the discounts and travel insurance, saving money before you’ve even arrived at your destination. Its suitability as a travel credit card is reinforced by the absence of any foreign transaction or foreign currency fees. Check out our detailed review here:

Which Alternatives Are There to the Free TF Bank Mastercard Gold?

TF Bank’s gold credit card is a solid free credit card. However, there are alternatives like the Advanzia fee-free Mastercard Gold. Advanzia’s credit card is also gold, charges no annual fee, no foreign transaction fees, and offers installment payments. As with TF Bank, interest is charged immediately on cash withdrawals. The difference is mainly in the interest rate: Advanzia’s interest is 19.44% for both card purchases and cash withdrawals.

Other free credit cards include the Hanseatic Bank GenialCard and the Barclays VISA Card. Both are entirely free for payments and withdrawals at home and abroad. However, for example, the Hanseatic credit card is not available to Austrians.

If you want a travel credit card with many additional benefits, the American Express Gold Card could be an option. The gold Amex also includes insurance coverage, as well as extra perks like exclusive hotel discounts. However, the American Express credit card charges a monthly fee of €12.

Who Is TF Bank: Contact and Information