American Express Platinum Card: Our Amex Experiences

The Amex Platinum Card is probably the most famous credit card in the world. It’s a brand you see in Hollywood movies and among celebrities. A card that offers countless benefits and lifestyle upgrades, opening exclusive doors. And a price tag that’s quite hefty.

We’ve been using the American Express Platinum for a few months now—one in the Business version and one in the personal version. We can already say: The number of benefits available can sometimes be overwhelming, and it takes some “work” to find the right ways to make use of them:

- €200 travel credit per year,

- €150 restaurant credit per year,

- another €200 each at Dell and Sixt—every year.

- Plus access to over 1,200 airport lounges,

- a comprehensive insurance package,

…and so on. It takes a while just to find and list all the benefits. So take a little time today as we present you with the American Express Platinum benefits, the costs, the requirements, and pretty much everything else we consider relevant.

The American Express Platinum – The Best Credit Card in Germany?

- Amex Platinum charge card in elegant metal

- Financial benefits: €200 for travel, €200 for rental cars, €150 at restaurants, and more

- Airport lounge access, private Amex events, and status upgrades at hotels and car rentals

- Collect Membership Rewards points and redeem them for offers

- Countless additional benefits, available as a personal, business, or partner card

If you’re ready to pay the €850 annual fee (through the end of 2024 it was €700 or €720 per year), then we’d generally say: “yes.” At that price, it’s 5 times as expensive as the American Express Gold. For such a steep price, one can (and must) expect corresponding quality. Let’s take a closer look and try to explain the wealth of advantages (and some disadvantages) one step at a time.

American Express Advantages and Disadvantages at a Glance

Advantages

- The card looks impressive: A metal Platinum card + a free Platinum partner card

- Countless financial benefits: €200 annual travel credit, €200 annual SIXT Ride credit, €200 annual Dell credit, and more

- Regular new benefits, including real gems like: €150 annual restaurant credit at over 1,400 restaurants and more

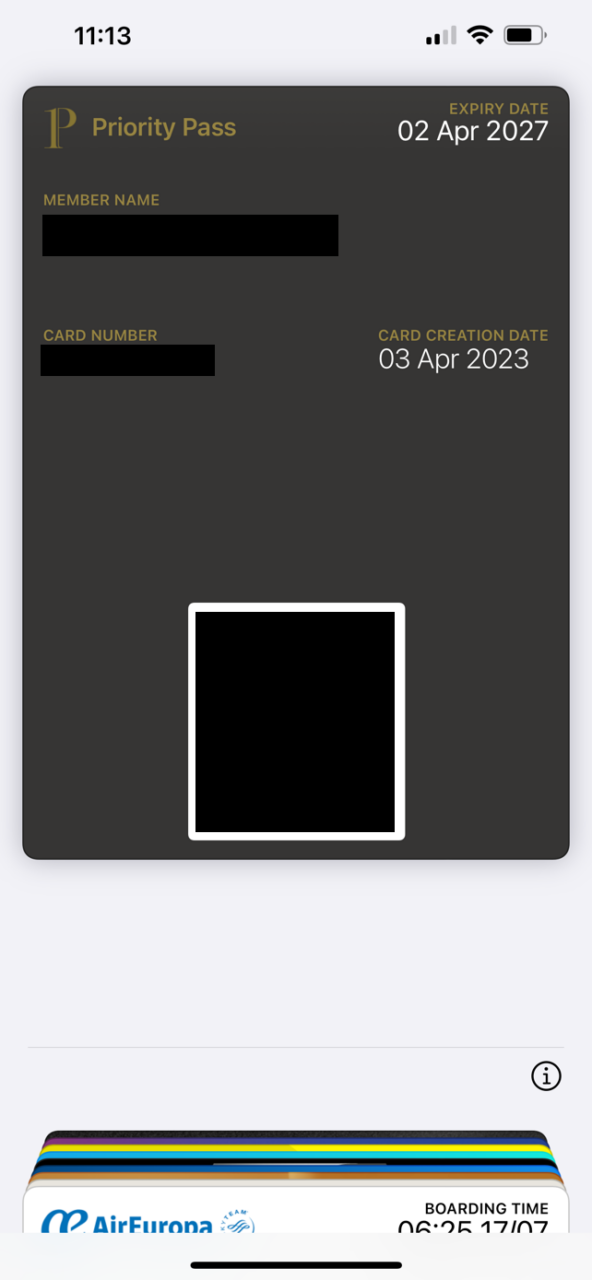

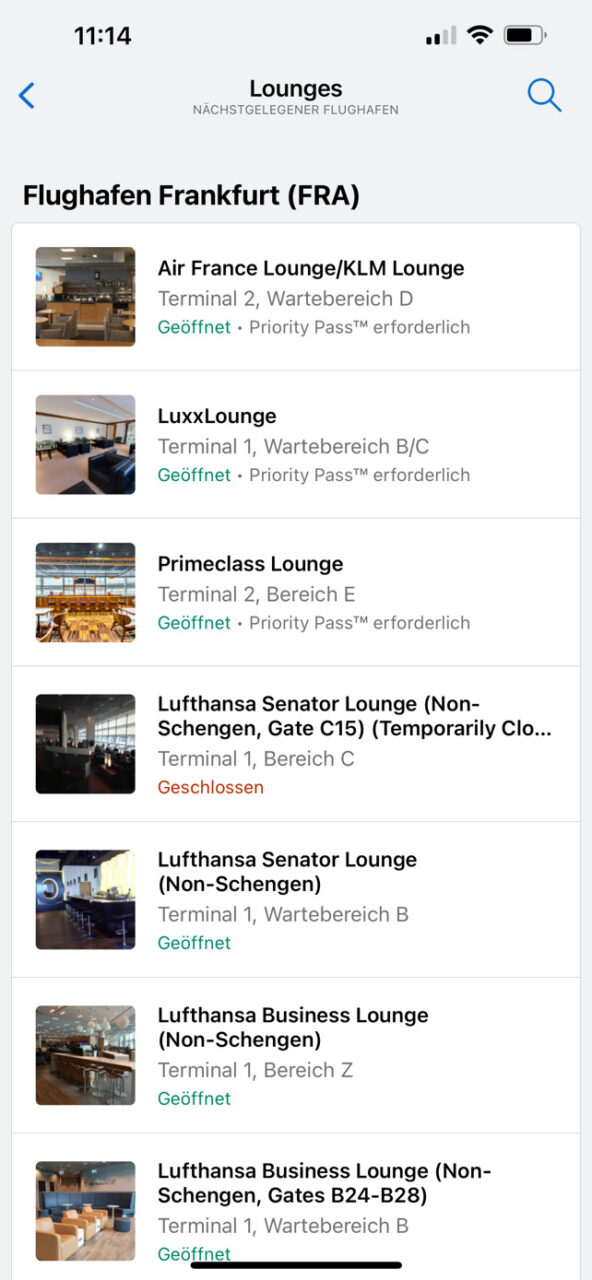

- Lifestyle upgrades: Access to over 1,200 airport lounges worldwide with Priority Pass (including Lufthansa Business Lounges). Fine Wine Club, Global Dining Collection with access to exclusive gourmet restaurants around the world

- Status upgrades for travel and car rentals: Hotel and travel partner upgrades (Hilton Honors Gold Status, Meliá Rewards Gold, and more). For rental cars: Avis Preferred, Hertz Gold Plus Rewards, SIXT Platinum Card

- Earn points for every euro spent: Collect Membership Rewards points with all your expenses. Rewards Turbo with up to 20,000 extra points per year.

- Convert points into euros or miles: Convert each euro spent into miles with partner programs (e.g., Miles & More, Emirates) or directly redeem miles as euros

- Regular special offers: Sometimes up to 75,000 Membership Rewards upon opening an account or inviting friends (depending on availability)

- For high earners: The Platinum Card is often the gateway card to gain access to the exclusive American Express Centurion Card

Disadvantages

- “Not exactly cheap”: Quality comes at a price. The American Express Platinum now costs €850 annually in the Business version

- Utilizing the benefits isn’t always straightforward: Some features need to be activated by phone, in the app, or on the web before they work. There’s a lot of fine print and conditions, for example at Sixt or for status upgrades, to fully understand them

- Lower acceptance rate compared to VISA and Mastercard: Amex comparatively has fewer acceptance points, meaning you can’t use it everywhere in everyday life. However, acceptance has increased significantly in recent years thanks to contactless payment. Especially for large expenses (travel, hotels), you can generally use Amex without any issues

- Website and app can be a disaster: American Express was founded in 1850 (!). The product, website, and apps have grown over the years—and not everything works on the first try—or sometimes not at all. Given the number of features, that’s almost inevitable. It can be frustrating if you want to sign up for offers

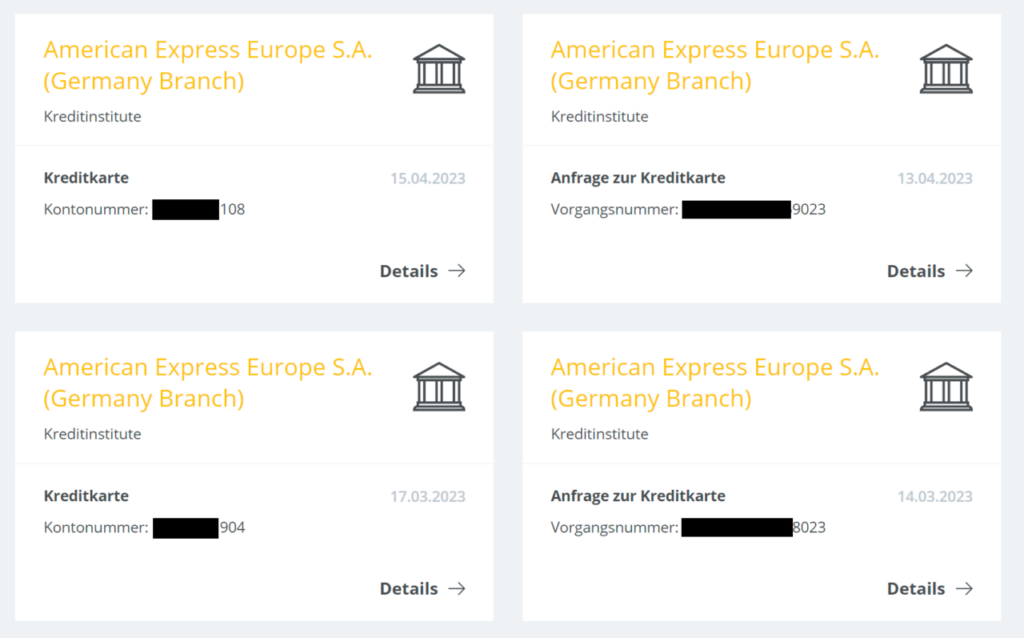

- SCHUFA check and reporting: It’s obvious that with a card offering a significant limit (we got over €10,000 right away), they check SCHUFA. But since we have both the Business version and an additional personal card, SCHUFA was queried twice and two credit cards were reported to SCHUFA. Having two credit cards within one month noticeably impacted our SCHUFA score

🔒 Secure and encrypted

American Express Benefits in Detail – How to Use Them

We tried to divide the benefits into four different categories to make them easier to understand. We essentially see four categories of advantages:

- Financial upgrades: You get a monetary value by using the card

- Lifestyle upgrades: You get everyday benefits, especially in the travel, concert, and event segments

- Status upgrades: In hotels, with rental providers, or in shopping malls, you get immediate status perks with the card

- Collecting points: By using the card, you collect Rewards points that you can then use

1. Financial Upgrades: How to Use Your American Express Travel Credit

To enjoy your benefits, you need to use the card for purchases and bookings. This is how it works.

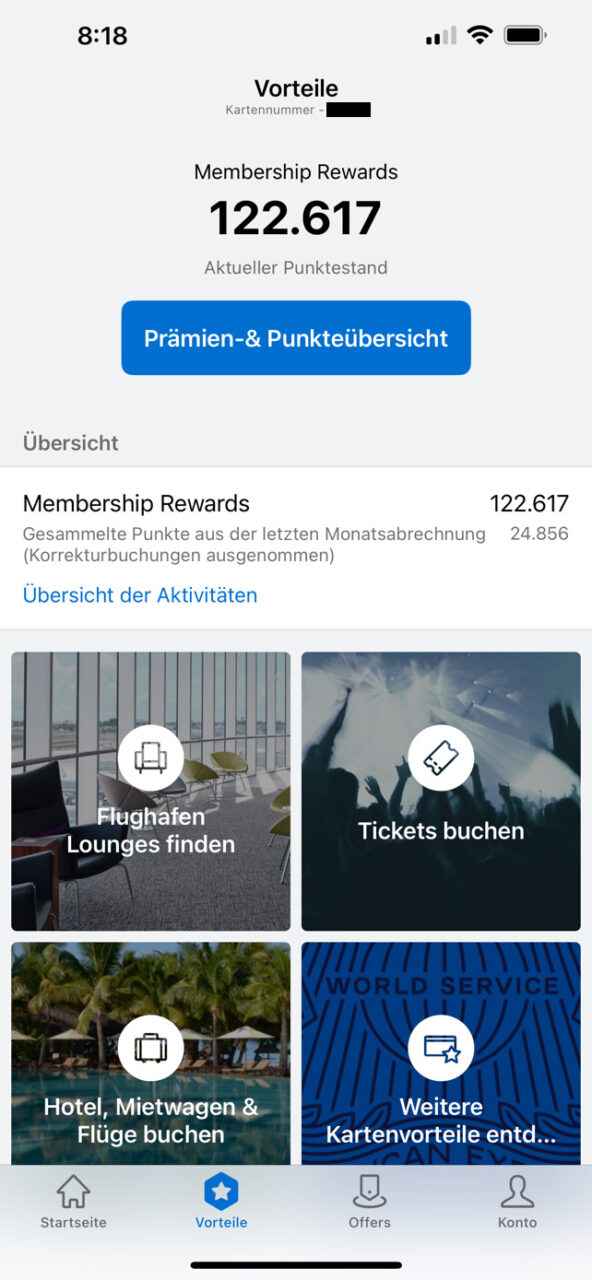

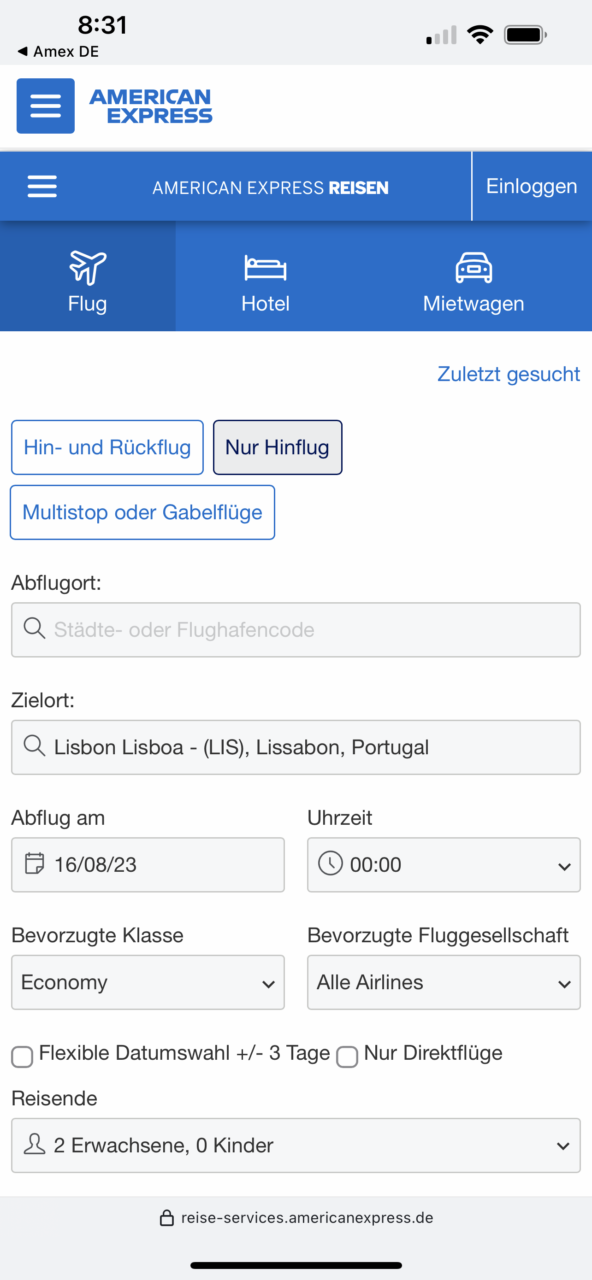

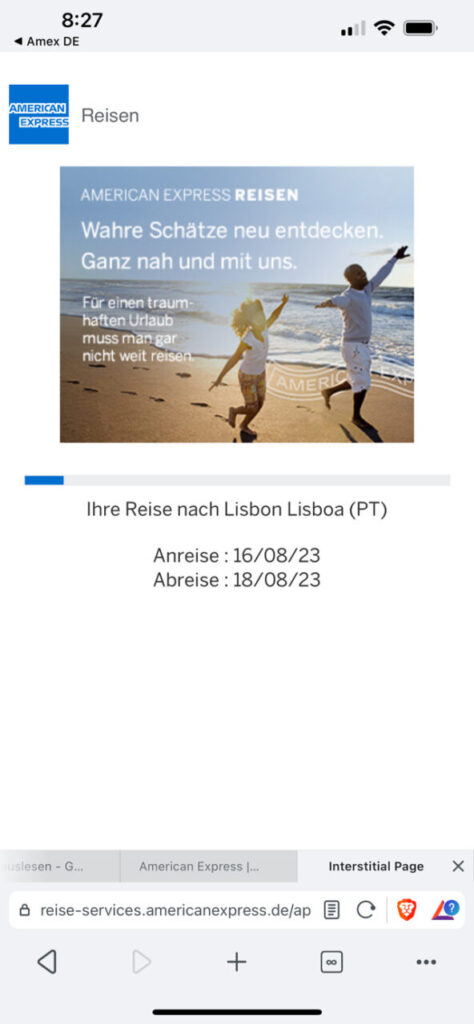

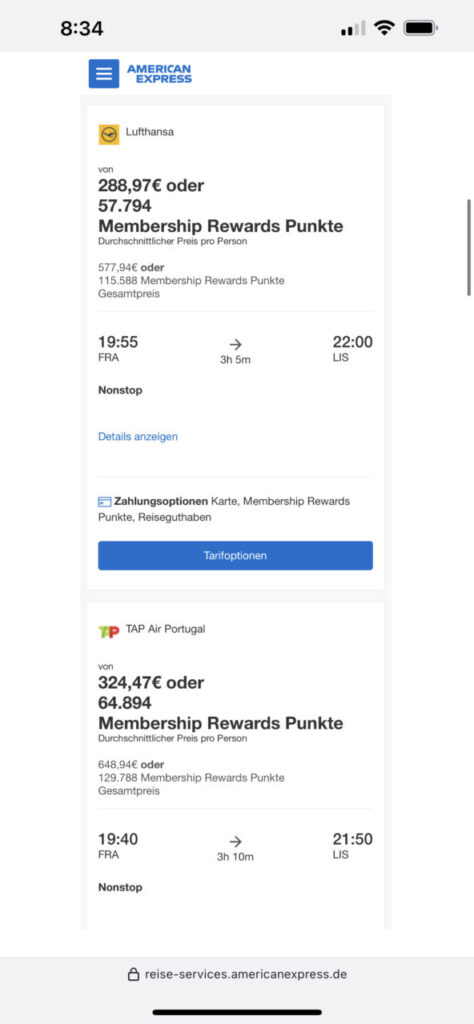

If you want to use the €200 travel credit, for example, open the “Vorteile” (Benefits) tab in the American Express app and select a travel destination. There you can use your card, benefits, and points for flights, rental cars, or hotels.

The benefits and travel bookings apply to almost all airlines and countries we tested.

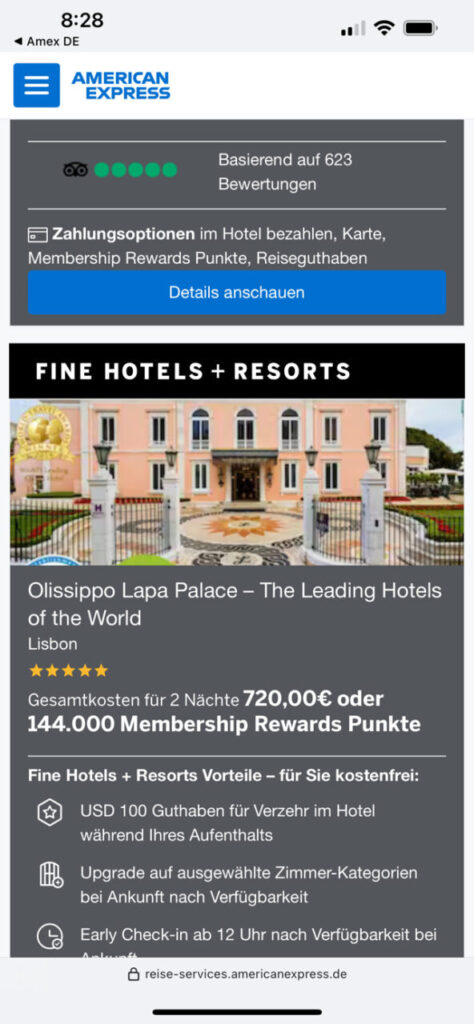

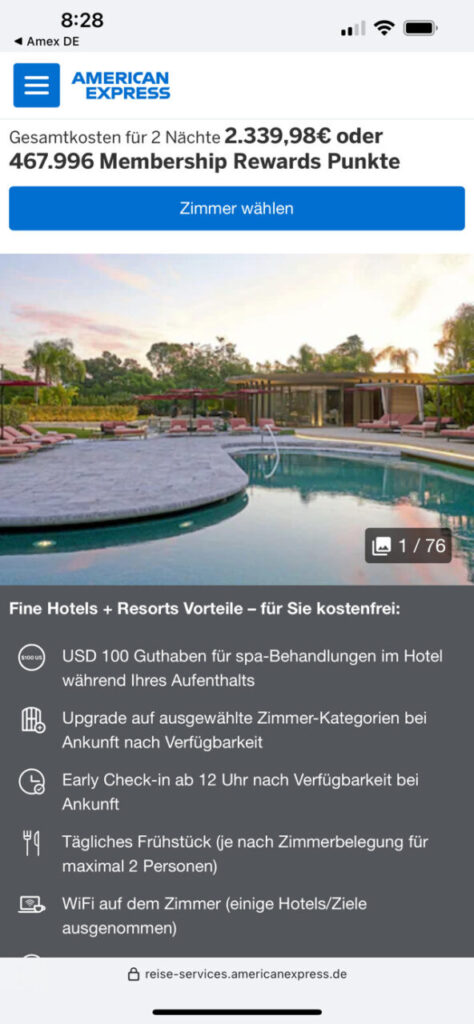

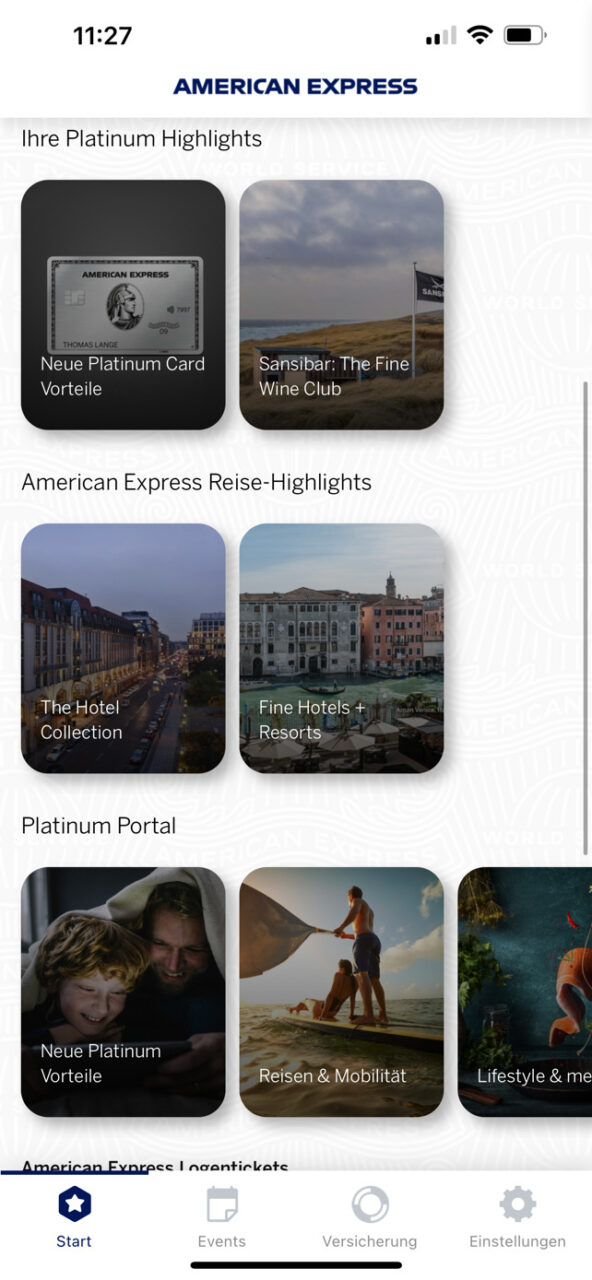

At hotels, especially selected ones, there are additional Amex perks because American Express has direct partnerships with certain hotel chains. Besides the status upgrades at Meliá or Hilton, there are also offers in Fine Hotels + Resorts partner programs and in “The Hotel Collection” (where you get the extra USD 100 credit).

2. Lifestyle Upgrades: Lounge Access, American Express Events, Concert Tickets

We’ve already seen some of these lifestyle upgrades during the travel process. Besides extra hotel credits, you may get early check-in, free breakfast, and even $100 in extra credit if the hotel belongs to “The Hotel Collection” or “Fine Hotels + Resorts,” two hotel groups partnering with Amex.

How else can I make my trip more pleasant with my Amex? With the business lounge at the airport:

Another great benefit of the Amex Platinum is its partnership with “Priority Pass.” This gives you free access to over 1,200 airport lounges worldwide with the American Express Platinum. To get this access, you need to register your card number in the Priority Pass App after applying for the credit card. Once registered, you’ll get your virtual card—though you’ll also receive a physical card in the mail.

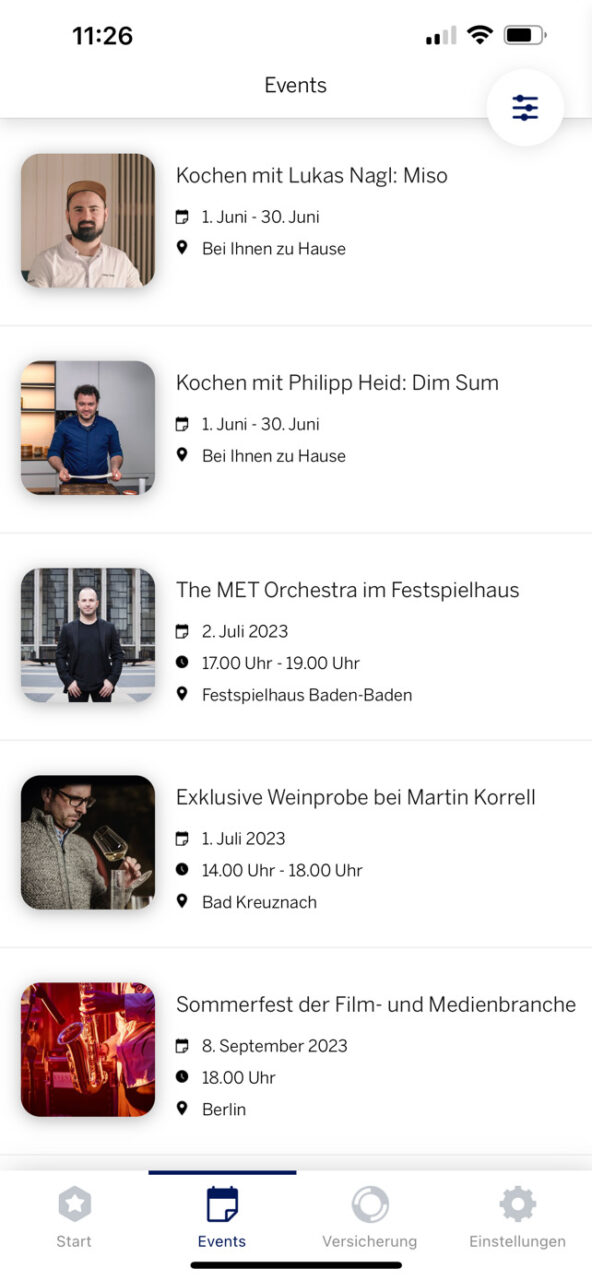

In addition to lounge access, you can also participate in exclusive American Express events. For this, Amex has developed its own app called AmexExperiences.

There you regularly find either exclusive American Express events or discounted VIP tickets for many events and concerts, such as comedy specials, cooking classes, shopping offers, and travel highlights. More on that below.

3. Status Upgrades: Activate Them First, Then Enjoy the Upgraded Status

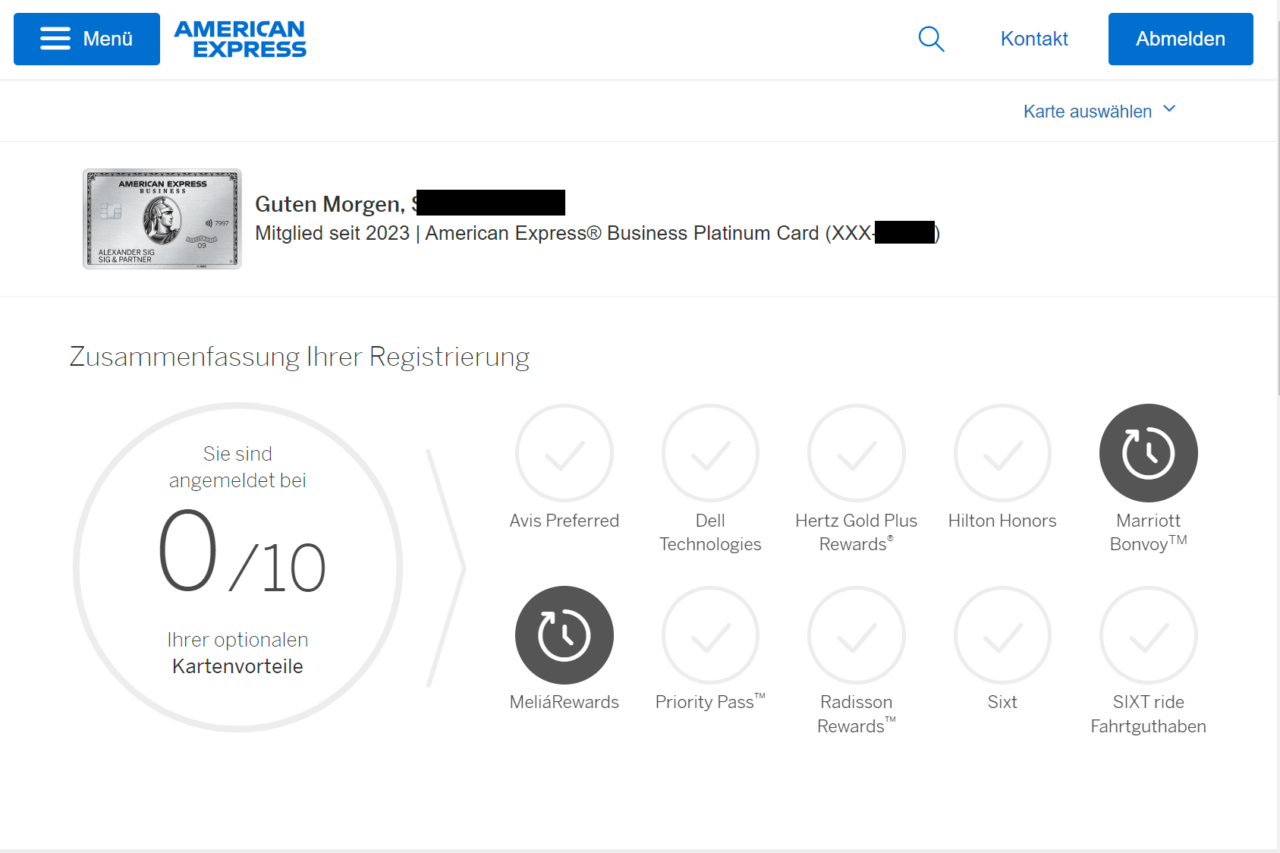

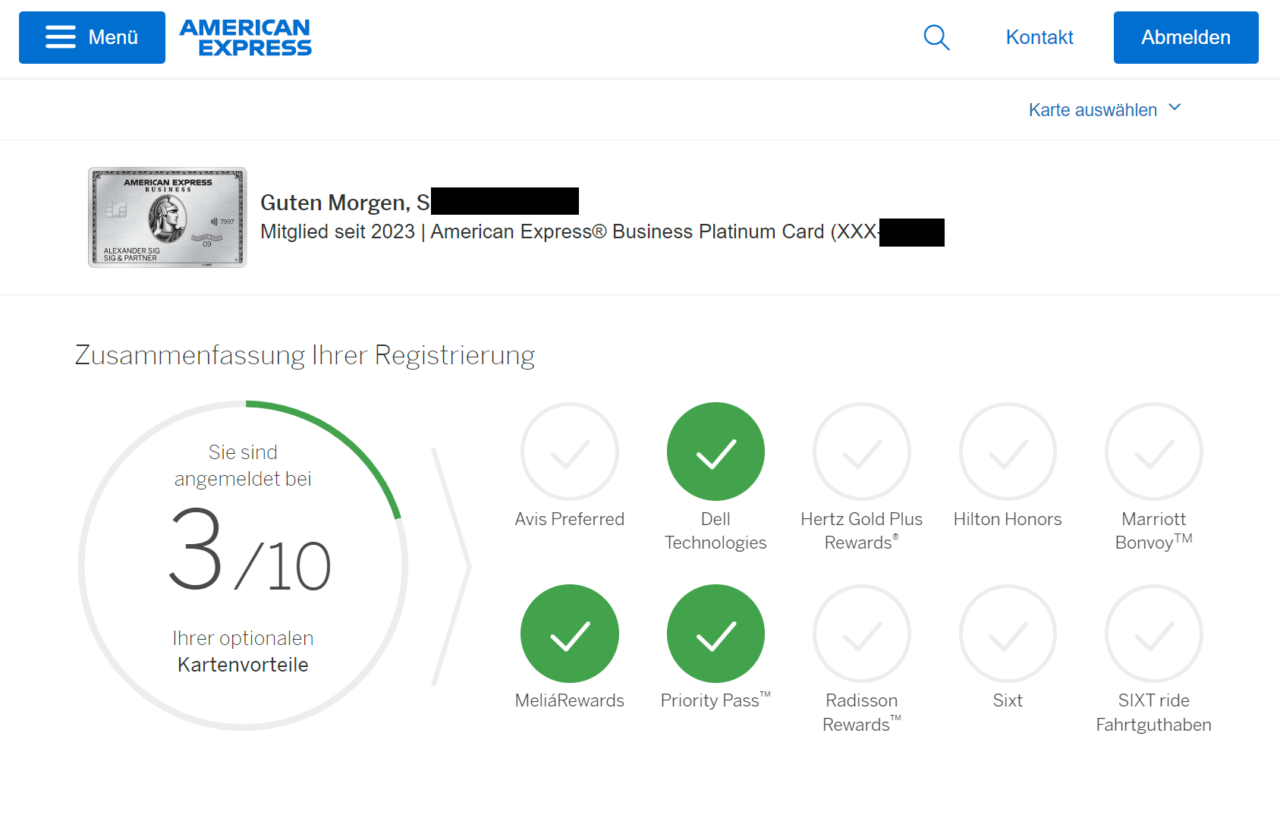

You have to activate some of these upgrades first. To do this, go to www.americanexpress.de/partnerprogramm, log in with your account, and then activate the benefits. These include discounts at Dell, the SIXT ride credit, and status memberships at Hilton, Radisson, Meliá, as well as rental car providers Avis, Sixt, or Hertz.

For Hilton and Meliá, you also have to register separately, so you get a customer account and a customer number that you must provide during activation.

The benefit with Dell, for example, works immediately when you simply pay with your Amex. Note that the benefit is capped at 2× €100 (not 1× €200 at once).

By the way, if you use both the Business version and the private version as an additional card, you need to select the benefits separately for each card for them to take effect.

4. Membership Rewards: Earn Points and Rewards With Every Euro

One of the most appealing advantages is, of course, that you collect Membership Rewards points for every euro you spend. Additionally, upon signing up, you often get another 15,000, 30,000, or sometimes even up to 75,000 Membership Rewards points credited to you, depending on the promotional period. You can then use these either for purchases, for travel, or to exchange for other benefits.

AmexExperiences App

With Membership Rewards, you not only have the opportunity to earn extra points but of course also to spend points.

Amex offers new events, deals, and exclusive highlights almost every week, for which you can use your Amex Platinum Card and its benefits.

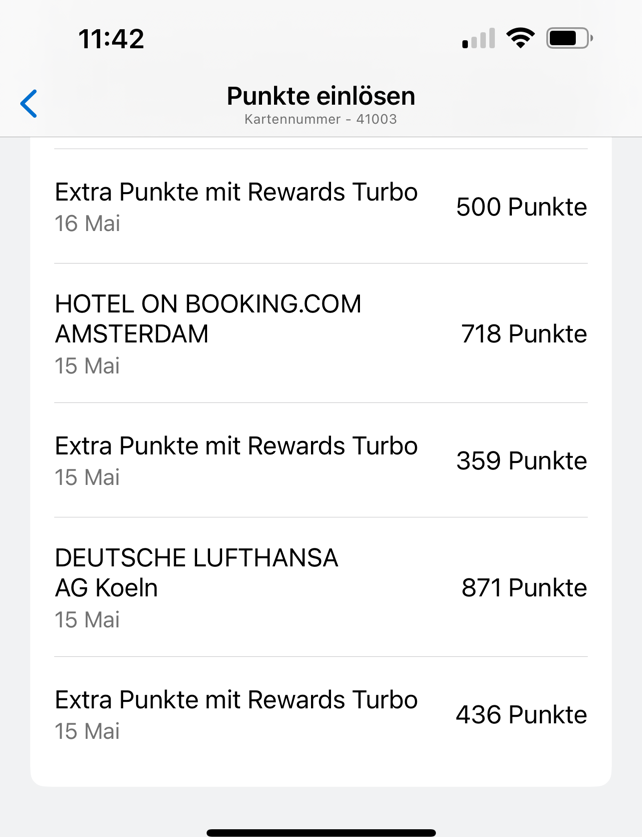

2 Tips: Activate Membership Rewards Turbo and watch your transactions

1. If you use your card frequently, you should definitely activate the Membership Rewards Turbo. The best way is by calling the phone hotline printed on your Amex card. You pay €15 per year for the Turbo and receive 50% more points. The Turbo is capped at up to 20,000 extra points per year.

2. Check the app and your statements from time to time. You’ll often find relevant offers there that you can activate directly on your card to earn extra points.

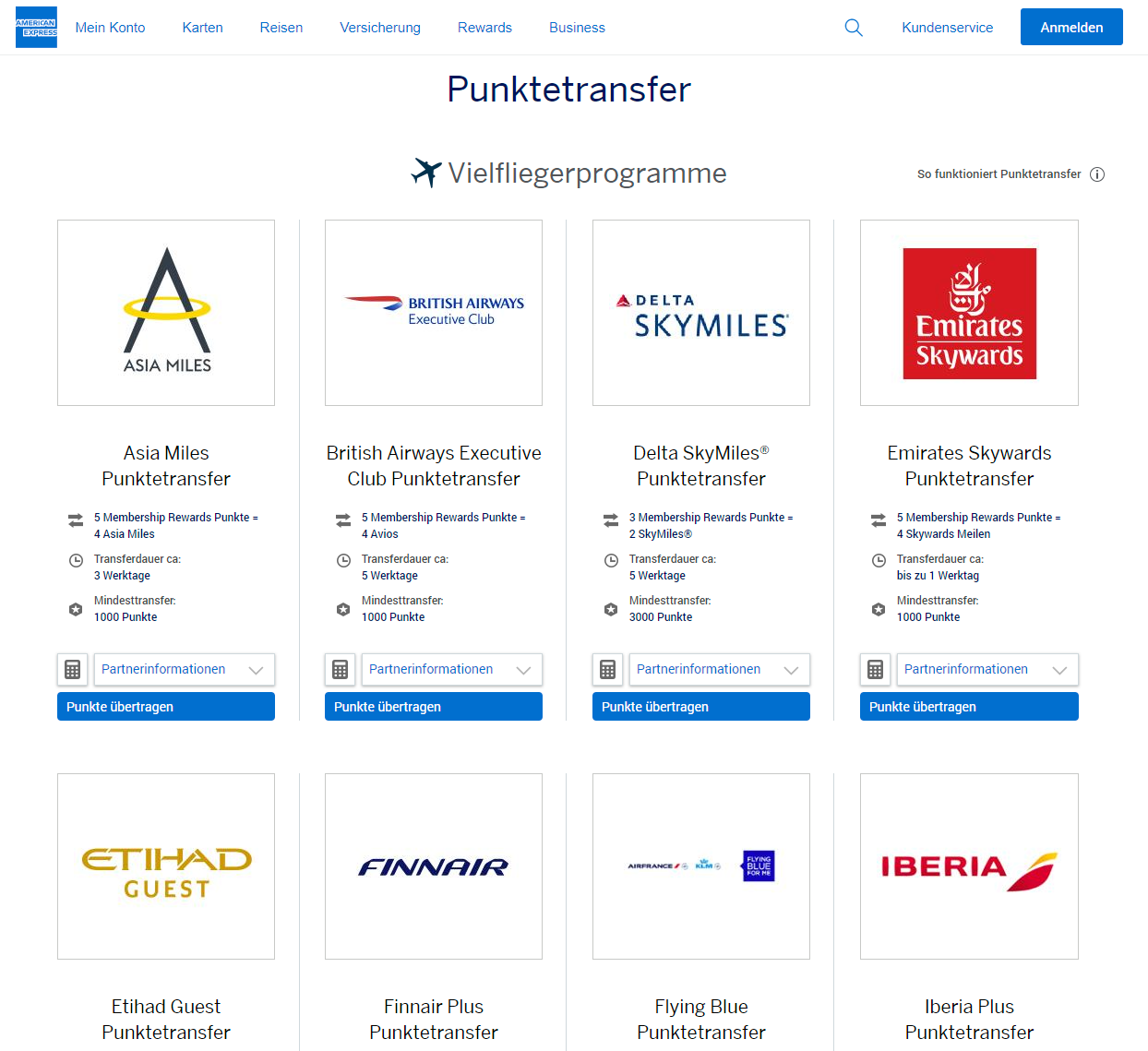

Converting Rewards Points into Miles: Amex Offers an Excellent Exchange Program

What we especially like about these Rewards points is the ability to convert them into numerous other mileage and bonus programs. American Express lets you, for example, convert your collected Rewards points to Emirates Skywards, SAS, Iberia Plus, or Etihad. Typically, the exchange rate is 5 Rewards points for 4 miles, sometimes 3 points for 2 miles.

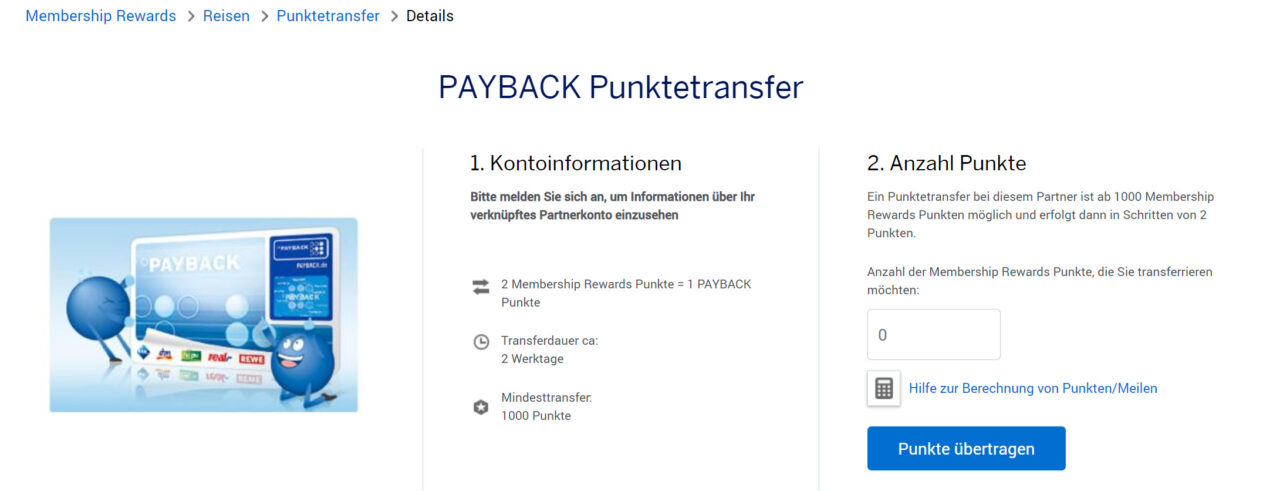

To redeem your Rewards points, look for the “American Express Punktetransfer,” where you’ll see the current programs for swapping. This makes the American Express Platinum one of the best credit cards for collecting miles and exchanging them.

If you’re wondering about Lufthansa, we have to disappoint you since Miles & More can’t be directly exchanged from Amex. But there is a workaround: You can convert your American Express points into Payback points at a 2:1 ratio. You can then convert those Payback points into Miles & More miles at a 1:1 ratio. By the way, there’s also a separate, free American Express Payback credit card you can test.

Let’s do a bit of math: 1 euro gives you 1 Reward point, or 1.5 Rewards points if you’ve activated the Rewards Turbo. Then, for instance, 10 Rewards points become 10 Payback points, which you can convert to 10 miles. That’s a rate of 0.75 miles per euro. With the Miles & More credit card, you only get 0.5 miles per euro—so the Amex with Rewards Turbo is a hidden gem if you want to collect extra miles!

Drawbacks of the American Express Platinum Card

Now that we’ve covered (most of) the Amex benefits, it’s time to take a more critical look at the card and highlight what doesn’t work so well.

The biggest difference from the usual VISA and Mastercard credit cards is the acceptance rate. Especially at local shops, supermarkets, or kiosks, American Express may not be accepted. Here, a debit card from VISA or Mastercard is generally more reliable. However, for larger amounts—especially on travel portals—Amex is typically accepted without any issues.

Another less-than-ideal aspect is the management of benefits and the overall clarity of the offer. Many of the benefits must be activated separately, which means: visiting the website, logging in, finding the benefits, activating them, and so forth. For the Miles Turbo, for instance, you have to call by phone to enable it (for a €15 fee).

The website login process sometimes works and sometimes doesn’t. You can tell Amex is a massive company that has grown over decades—and behind the scenes, there are thousands of individual programs and services that have been added and removed over time. Eventually, things go wrong.

Another disadvantage is the detailed conditions of the perks. For example, €200 free at Sixt sounds great—but the devil is in the details. The €200 is for Sixt Ride, and you can use a maximum of €20 per booking, meaning you have to ride with Sixt at least 10 times a year to get the full benefit. The automatic vehicle upgrade is only valid for the first 12 months after issuance unless you’re a “power user.”

American Express Platinum and SCHUFA: Double Entry for Business and Partner Cards?

What really bothered us was our SCHUFA score. We applied for the American Express Platinum Business and also got the partner card. What we didn’t know: American Express checks your SCHUFA record for every single application, even if it’s for the same person. Also, each credit card is reported individually. Even the Amex Platinum Business is listed as a personal credit card in the record, even though the billing goes through the company (a GmbH).

Because we applied for the cards within four weeks, 2 new credit cards were reported to our SCHUFA record in a very short time. This had a direct effect on our SCHUFA score, which worsened at the last calculation.

We would have preferred a somewhat milder solution instead of immediately reporting two credit cards.

Conclusion on the American Express Platinum Card

Our overall impression of the American Express card remains very positive. It took some time to initially “understand” the card and learn how to use all—or at least most—of the benefits. Even after several months, we still regularly discover new features and functions.

You definitely pay for the card. During the credit check, they do check for a certain creditworthiness. We haven’t seen a direct credit limit displayed for the American Express yet; we could already book a four-digit amount in the first month, which was then debited from our account (after 30 days).

One thing that can definitely be tiring is the functionality of the website and the logins. You can tell that there are many different portals Amex uses, and some pages take a long time to load, which can make the process of booking hotels or flights a bit more cumbersome.

All in all, we can recommend American Express both as a premium credit card, a travel credit card, or even a primary card for everyday use—provided you have the right lifestyle—and we plan to continue updating our review.

🔒 Secure and encrypted

Contact American Express: Who’s Behind the Card?

| Company name | American Express Europe S.A. |

| Company type | Kreditkartenunternehmen |

| Address | |

| Website | |

| Phone | |

| Hours | |

| Social Media | |

| English support | No |