Credit card number: Everything you need to know

Credit cards are a popular payment method in Germany. If you are travelling or living in a German city, you will probably use them often. On your credit card or prepaid credit card you can actually find different numbers combinations:

- the credit card number

- its expiration date

- the Card Verification Value (CVV) or Card Verification Code (CVC)

- a PIN for ATM cash withdrawals or purchases in retail stores

Today you can find where your credit card number is, how to recognize a fake credit card number and how you can generate your own credit card number.

Here you can find the most relevant info about credit card numbers

All you need to know about credit card numbers at a glance

- Every credit card has a 12- to 16-digits credit card number embossed on its front side

- Credit card numbers are important identifiers

- When paying online, you will always need your credit card number together with card’s CVV or CVC, expiration date and a PIN code

- You cannot use fake credit card numbers for your online purchases

What is the credit card number and where can you find it?

The credit card number is a 12 or 16-digit number grouped in slots of 4. It is an identification element of your credit card. Since credit card numbers are created using the same system, they are all structured in the same way. The credit card number identifies the type of credit card and the card issuer. It contains the bank account number and a checking number. Due to the fact that credit card numbers are structured in the same way, their validity is easy to prove. The credit card number is placed on the front of your credit card. When paying in shops, businesses or service providers, the presentation of a credit card triggers a payment at these acceptance points. In this case, payments are assigned to your correct credit card account using your credit card number. When paying online, since the card cannot be physically presented, you will need your credit card number in order for your card to be identified. Furthermore, you will need the expiration date and the CVV or CVC (security code) of your credit card.

What are virtual credit card numbers?

Some credit card providers, as bunq, give you the possibility to generate different virtual credit card numbers for your online purchases. In the best case, you have already applied for a bank account and a credit card so that you can generate your virtual credit card number through your online account. You only need to look for “virtual card number” or “virtual account number”. With bunq you can possess up to 5 virtual cards for free. If their details are compromised or you doubt the security of your online purchases, you can generate new virtual credit card numbers. bunq will provide you with a complete credit card number and the respective CVV code.

In the list below you can find some of our suggested providers of virtual credit cards:

Credit card number: Composition and examples

ABCD EFab cdef ghiX

Your credit card number contains three pieces of information: the Bank Identification Number (BIN), your account number and a checking number:

- The Bank Identification Number (BIN)

The first 4 characters (A-D) identify the credit card issuer. The first character (A) identifies the issuer’s industry, which in combination with the second character recognizes its company. VISA credit card numbers start with number 51 to 55 while MasterCard numbers begin with 4.

Number 5 (E) indicates the type of credit card.

Number 6 (F) shows if it is the credit card of an additional cardholder, a second credit card or a business credit card.

- The account number

Numbers 7 to 15 (a to i): this combination of numbers identifies your bank account number and can have 6 or 10 digits according to your credit institute.

- The checking number

Number 16 (X) represents a checking number. Through the Luhn algorithm you can validate your credit card number using the last digit of your credit card number.

As you can see, the credit card number is not only important for shopping online and to pay when traveling, it also contains a lot of important information that helps to check the authenticity of a card and to assign it to the correct cardholder. Your credit card number helps to prevent credit card frauds.

Your credit card’s design

Credit cards are produced in a check card format according to the international standard (ISO / IEC 7810) for identity documents. This means that the credit card has the same dimensions as your driver’s license, your health insurance card and your debit card. It has the format ID1 with the dimensions 85.60 mm x 53.98 mm.

Information on the front of your credit card:

- The credit card number is stamped in relief and sticks out over the hologram on the right

- The first four digits of the BIN code in lower case below the credit card number

- The month of issue of the card in the form MM YY, which is marked as “valid from”

- The period of validity of the card is in the form MM YY and is labeled with “until end”

- The full first and last name of the credit cardholder

- The logo of the credit card company. Visa Card and Mastercard are the most frequently represented credit card companies.

- The encrypted data for the authorization of a transaction are stored on the security chip (EMV). The chip is scanned by card readers to read these out after the customer has been authenticated, for example by entering a PIN.

- Security signs such as the hologram and security features in ultraviolet light that cannot be copied and make it difficult to forge credit cards

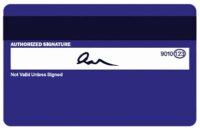

Information on the back of your credit card:

- The signature field: As soon as you receive your credit card, you should sign it in order for it to be a valid credit card. Retailers will compare your signature with the signature on the receipt of your purchases which helps you to be protected against credit card fraud.

- The Card Verification Value (CVV) or Card Verification Code (CVC), also known as security code. Mastercard CVC code and VISA CVC code consist of three or four digit combinations which is particularly relevant when shopping online. The CVC number is not embossed. It is printed on the back of your credit card so it is difficult to be read by machines. You will have to give your CVC or CVV code when paying online to prove that you have the card with you.

- The CVV or CVC is stored on the magnetic strip. It is recorded when you swipe your card through the card reader during the payment.

- Additional infos from the credit card issuer which depends on the type of credit card.

Tips and tricks for secure credit card payments

- Sign your credit card as soon as you receive it

- Make a careful note of your PIN. Do not write it down or give your PIN by email or phone. Your bank would never ask for your PIN.

- When paying with your credit card, make sure that the amount stated on the receipt is correct and that you get your card back directly from the seller.

- Do not write down the card security number

- Only enter your credit card number and card verification number on reputable sites. As a rule, most companies use encrypted pages to avoid reading out this sensitive data. You can recognize these SSL encrypted pages by the address line that begins with https: //. You can also recognize reputable online shops by their well-known quality seals such as the TÜV certificate.

- Check your bills regularly. You can always recall incorrect invoicing and request a chargeback.

- Block your credit card immediately, if you suspect a fraud. Write down a list of all your credit card numbers: your Deutsche Bank credit card number, Commerzbank credit card number and others. In addition, you should also note down the telephone numbers of the service hotlines and keep them where a stranger cannot find them so quickly. So you always have all your important data to hand if you need to block your card.

Did you find this page useful? Do you have any further doubts about credit card numbers? Leave a comment, we look forward to reading your feedback!

Can I apply for just only one credit card through online? How?

I need a Credit card 💳 please

what to investigate my credit card

I like it

Thank you

They’ve been taken, but looks like it worked for the people who have taken it! Thanks, for helping on people though.

thank you

thank you for your help

Can I apply for the credit card?

This is amazing coooooool

I want a debit card for free but I can’t get here in my country can you offer me I am from Ethiopia

Thanksgiving service 👍💘💘💞💕

Exellent and transparance oll assestment🙏thanks all iwould youhupey♥️

Five ⭐⭐⭐⭐⭐

thank you for sharing your idea

Ty

I hope this will help me.

The credit Card that you posted are expired

Thank you!

thanks everyone